Homeowners, builders adjusting to buyer’s market in ’03

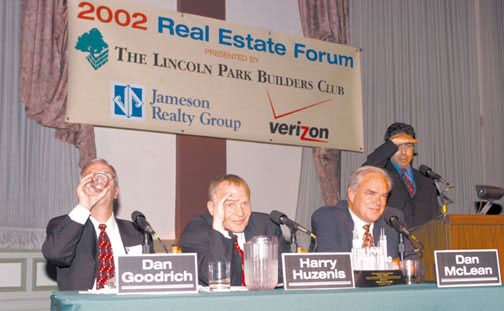

“Is this a bad market?” asked Harry Huzenis, of Jameson Realty Group, at a recent forum sponsored by the Lincoln Park Builders Club. “No. We’re seeing a deflation of inflated expectations.”

That line, which Huzenis attributed to his brother and partner, Charlie, got an appreciative laugh from the crowd of developers, brokers and assorted real estate types. Lukewarm as his assessment might sound, those who make their living from real estate – an extremely lucrative living for many during the late ’90s and early ’00s – liked the gradual, moderate, reasonable sound of that word, “deflation.”

The media during the last six months has been using a much uglier word, one that begins with a “b” and rhymes with “worst.”

The specter of a so-called “housing bubble,” not unlike the bubble that has caused so much grief in the stock market, has begun to hover over what remained the one consistently bright spot in the sluggish economy.

The specter of a so-called “housing bubble,” not unlike the bubble that has caused so much grief in the stock market, has begun to hover over what remained the one consistently bright spot in the sluggish economy.

In general terms, housing tends to follow the contours of the overall economy. As unemployment grows, the stock market takes a tumble and economic growth slows, housing cools off. But propped up by low interest rates and seen by growing numbers as an alternative to the stock market, housing has defied the current economic downturn, proving unbelievably – some say unrealistically – resilient.

Since 1995 housing prices have jumped more than 50 percent nationally, around 32 points above inflation. In Chicago, the median condo sold for $226,500 during 2001, an increase of 107 percent over the 1993 median of $109,500. In hot neighborhoods such as Uptown and Lincoln Square, median condo prices rose more than 25 percent in just one year, from 2000 to 2001.

That sort of runaway appreciation has created some interesting and perhaps unhealthy dynamics in the local market. Investors attracted to big returns at new residential developments and disappointed in the stock market have been snatching up units at a quick pace in many projects. Such speculation inflates sales numbers early on at a development but can cause problems down the road. Many of these units get dumped back on the market as soon as they’re completed, competing with developers’ units for buyers. Some deals by overly ambitious investors fall through before closing and others result in condos being operated as rentals, which hurts the already suffering apartment market and can lower values in a condo building.

A number of developments that announced fairly quick sellouts six months or even a year ago magically now have dozens of developer units for sale once again. Other projects that early on showed strong sales activity are having real trouble closing out the last half of their units even as they’re readied for occupancy. That pattern is continuing as the newest developments being marketed show initial bursts of sales activity at the expense of buildings that actually are delivering finished units. The inventory of unsold condos continues to grow while sales have slowed.

A number of developments that announced fairly quick sellouts six months or even a year ago magically now have dozens of developer units for sale once again. Other projects that early on showed strong sales activity are having real trouble closing out the last half of their units even as they’re readied for occupancy. That pattern is continuing as the newest developments being marketed show initial bursts of sales activity at the expense of buildings that actually are delivering finished units. The inventory of unsold condos continues to grow while sales have slowed.

In its quarterly “Residential Benchmark Report,” Appraisal Research Counselors records an unsold inventory of about 2,900 condos, lofts and townhouses that are completed or under construction in the downtown area. Given an annual for-sale demand of about 3,400 units, this amount doesn’t in itself seem like cause for alarm. But the record number of condo deliveries this year coincides with major apartment deliveries (a total of 6,400 rental and for-sale units in ’03). Consider that many of these sold condos may be rented out or immediately put back on the market by investors or developers and things start to look crowded.

Another effect of rapid appreciation has been great expectations on the part of sellers, who have had trouble adjusting to the idea of a buyer’s market.

“There is a disconnect between sellers and buyers on expectations,” says Harry Huzenis, of Jameson. “We’re seeing sellers stuck on $360,000 when we could sell their home all day long for $330,000.”

The odds are good, however, that Chicago will see much more modest price increases during the next couple of years. That news might be disappointing for homeowners who wanted to cash in on the steep appreciation they’ve been hearing about, but it’s probably good news for the market overall.

The cost of housing has risen much faster than incomes and continuing the recent dizzying pace could lead to a crash that would ripple throughout the economy.

This possibility was announced, perhaps a little sensationally, throughout the media as 2002 came to a close. “Is real estate next?” trumpeted the Oct. 28 issue of Fortune: “With stocks in the tank, Americans are counting on home prices to keep rising. They won’t.” The New Yorker followed suit in November, with a story on “the Next Crash,” asking, “Is the housing market a bubble that’s about to burst?”

Some critics say the fear of a housing bubble is exaggerated and point to factors that distinguish the current housing boom from past cycles. The latest recession is by historical standards a mild one, and record low interest rates – below 6 percent at press time – have pumped life into residential real estate by stretching buying power. Demographic trends – the demand created by immigrants, empty nesters and “echo boomers” (children of the baby boom generation) – point to rising housing demand and a strong market for years to come, according to some observers.

But this hopeful talk sounds suspiciously like the rationale put forth by those who argued that the ’90s would witness the end of the business cycle and a “new paradigm” created by great strides in technology and productivity. That theory was crushed under the weight of a much simpler idea: things that go up tend, eventually, to come down.

Does this mean that now is not a good time to buy a new home in Chicago? Not according to Gail Lissner, of Appraisal Research Counselors.

“I’ve been tracking the market for over 25 years, and I actually haven’t seen prices drop,” Lissner says. “We’ve seen a flattening, a leveling off of the market. It doesn’t move up at nice neat levels of 2 to 4 percent year. We see spikes and flatness, but we’ve never had the peaks and valleys you see on the coasts. We’re not projecting any type of bubble.”

Chicago, heart of the prudent Midwest, has tended to avoid the boom-bust cycles that have hit the East and West coasts. Some argue that housing in the city, which in the 2000 Census recorded its first net population gain since World War II, has long been under-priced.

Part of the rapid rise in Chicago prices is a result of new demand for housing in the heart of the city, in neighborhoods like the West Loop, South Loop and River North, which barely existed as residential enclaves a dozen years ago. The city is perceived as being safer and cleaner, with more entertainment options, than at any time in the last 50 years, while commute times to affordable new suburban developments have grown dramatically. Under-performing public schools and high property taxes continue to be a drag on city housing, but it’s unlikely that the influx of residents to the downtown area will stop any time soon.

Buyers viewing the purchase of a new home primarily as an investment probably have missed the boat for the sort of quick return that was virtually guaranteed at new developments a couple of years ago. Projects that test well in the old categories of location, pricing and product may still offer solid short-term appreciation, but now is not the time for speculation.

However, for buyers who see a new home as first and foremost a place to live, now may be a great time to buy for several reasons. For starters, record-low interest rates have stretched buying power to new levels, and they’re not going to stay this low forever.

“Rates have been an unbelievable benefit,” says Charlie Huzenis. “What you could afford for $300,000 at 10 percent, now gives you $600,000 for the same (monthly) costs.”

And unlike many individual home sellers, builders understand that this is a buyer’s market. Concessions, or buyer incentives, offered by developers include free upgrades, price reductions, free parking spots, free assessments, special financing and no payments for a set period of time. More of these deals were advertised at the close of the year – always a slower time for sales – but many builders will bring out the percs for serious shoppers once they’re in the sales center.

“Developers definitely are dealing right now,” Lissner says. “It’s a little more like shopping for a car, though there are fewer of these concessions advertised this quarter than last quarter.”

Also, that growing inventory of unsold units in the current market means that buyers of new construction often can see and touch their new home before signing a contract. At the height of the boom, developments were selling out before units – or sometimes even a model – were complete. The inevitable gap between buyers’ expectations – created from brochures, floor plans and renderings – and the finished product can be narrowed considerably when you’re seeing exactly what you’ll get.

And for those who need to move into a new home quickly, many developments will be offering quick delivery of units during 2003.

One caveat that holds especially true in the current market is for buyers to consider carefully a developer’s track record. Lenders and equity partners have weeded out some less experienced builders by tightening the purse strings, but the fact that a project is marketing units does not necessarily mean it will get built. Only a few major projects in the last year came on-line and then folded before they could start construction – the Blackstone, the St. Clair and 390 N. Canal – but the danger is real for buyers who sign contracts and begin planning their lives around inchoate homes that disappear six months later.

Even well established builders are facing tough times at certain projects. At press time, developer Dan McLean, of MCL Companies, expected to close in late February on a buyout of investors in his River East development and to refinance the deal with new and existing lenders. Construction stopped last year on the second River View tower, a 32-story building with 148 units, when financing problems arose. Buyers who signed contracts on River View II condos have been left in an uncomfortable position while construction is delayed and MCL tries to save the project from foreclosure.

MCL is about 70 percent sold on the second River View tower and about 60 percent sold on the massive River East Center, a 620-condo highrise that includes an Embassy Suites Hotel and a 21-screen AMC movie theater. At press time, that left nearly 300 units currently for sale at River East in an environment where inventory is growing and sales are slowing. McLean, however, says the market is not as overbuilt as it might seem.

“There are 2,900 units on the market now under construction, but only 650 of them are available for delivery,” McLean says. “That’s about three months of inventory. So if we stopped building and had sales for three months, we would exhaust what’s available.”

But that inventory keeps expanding, and about a dozen mega-projects, some underway and others a year or more off, have the potential to add many thousands more units to the downtown market.

“We continue to watch that unsold inventory number, which is continuing to increase,” Lissner says. “It’s a delicate balance. Everyone always thinks their project is going to do better…The pace will slow down, and it has to because the market needs time to absorb.”